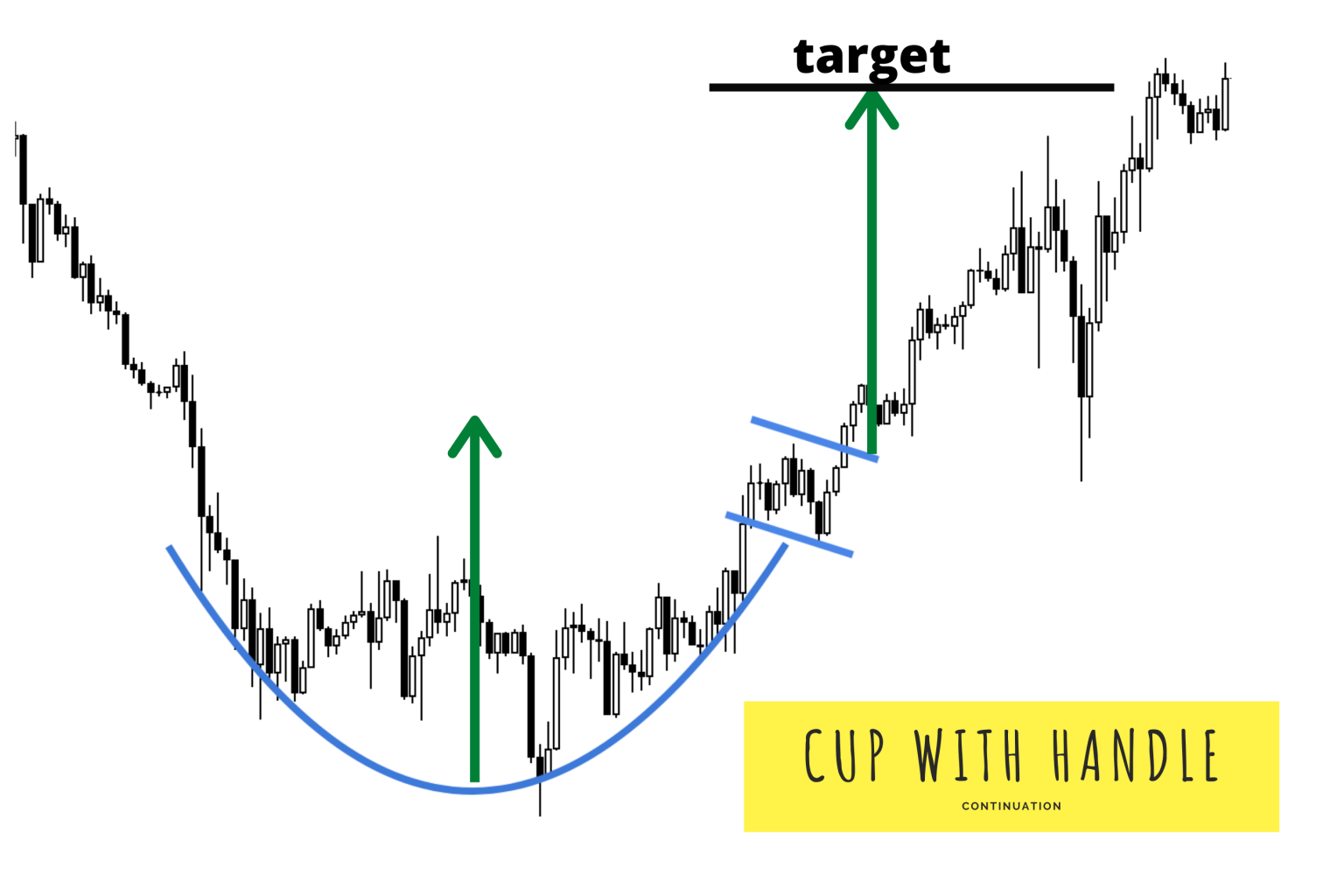

Cup And Handle Pattern In Bear Market . cup and handle formations can fail at a 5% or higher rate during bear markets. Learn how it works with an example,. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the base of the cup. this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. The inverted cup and handle is the bearish version that can form. The pattern takes some time to. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. a common stop level is just outside the handle on the opposite side of the breakout. This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. To mitigate the risk of a failed.

from www.newtraderu.com

This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. a common stop level is just outside the handle on the opposite side of the breakout. cup and handle formations can fail at a 5% or higher rate during bear markets. Learn how it works with an example,. The inverted cup and handle is the bearish version that can form. To mitigate the risk of a failed. this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. The pattern takes some time to. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart.

Cup and Handle Pattern Guide New Trader U

Cup And Handle Pattern In Bear Market cup and handle formations can fail at a 5% or higher rate during bear markets. this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. To mitigate the risk of a failed. The pattern takes some time to. Learn how it works with an example,. This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. cup and handle formations can fail at a 5% or higher rate during bear markets. The inverted cup and handle is the bearish version that can form. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the base of the cup. a common stop level is just outside the handle on the opposite side of the breakout. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend.

From www.kucoin.com

Trading 101 How To Accurately Identify and Trade the Cup and Handle Cup And Handle Pattern In Bear Market a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. a common stop level is just outside the handle on the opposite side of the breakout.. Cup And Handle Pattern In Bear Market.

From www.elementforex.com

Cup and Handle Pattern10 Simple Steps to Trading the Cup and Handle Cup And Handle Pattern In Bear Market Learn how it works with an example,. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. the cup and handle pattern is a bullish. Cup And Handle Pattern In Bear Market.

From artinya.isgkc.net

Cup And Handle Pattern Artinya Cup And Handle Pattern In Bear Market the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. cup and handle formations can fail at a 5% or higher rate during bear markets. The pattern takes some time to. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the. Cup And Handle Pattern In Bear Market.

From scanz.com

Cup and Handle Patterns Comprehensive Stock Trading Guide Cup And Handle Pattern In Bear Market this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. a common stop level is just outside the handle on the opposite side of the breakout. To mitigate the risk of a failed. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after. Cup And Handle Pattern In Bear Market.

From www.asktraders.com

The Cup and Handle Chart Pattern (Trading Guide) Cup And Handle Pattern In Bear Market the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. a common stop level is just outside the handle on the opposite side of the breakout. This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. The pattern takes some. Cup And Handle Pattern In Bear Market.

From www.alamy.com

Inverted Cup and Handle Pattern Bearish () Small Illustration Cup And Handle Pattern In Bear Market This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. The pattern takes some time to. The inverted cup and handle is the bearish version that. Cup And Handle Pattern In Bear Market.

From synapsetrading.com

Cup and Handle Price Pattern Trading Strategy Guide Synapse Trading Cup And Handle Pattern In Bear Market cup and handle formations can fail at a 5% or higher rate during bear markets. Learn how it works with an example,. The inverted cup and handle is the bearish version that can form. this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. a positive sign. Cup And Handle Pattern In Bear Market.

From www.binarytrading.com

Cup & Handle Pattern in Binary Trading Binary Trading Cup And Handle Pattern In Bear Market a common stop level is just outside the handle on the opposite side of the breakout. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. The pattern takes some time to. Learn how it works with an example,. To mitigate the risk of a. Cup And Handle Pattern In Bear Market.

From www.alamy.com

Inverted Cup and Handle Pattern Bearish () White & Black Bearish Cup And Handle Pattern In Bear Market cup and handle formations can fail at a 5% or higher rate during bear markets. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the base of the cup. The inverted cup and handle is the bearish version that can form. This decrease indicates that selling pressure may be drying. Cup And Handle Pattern In Bear Market.

From www.protradingschool.com

How to trade The Cup and Handle Chart Pattern Pro Trading School Cup And Handle Pattern In Bear Market This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. a common stop level is just outside the handle on the opposite side of the breakout. Learn how it works with an example,. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a. Cup And Handle Pattern In Bear Market.

From dxopvrjlu.blob.core.windows.net

Cup And Handle Formation Pattern at Eva Osborne blog Cup And Handle Pattern In Bear Market a common stop level is just outside the handle on the opposite side of the breakout. this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. The inverted cup. Cup And Handle Pattern In Bear Market.

From www.tradingview.com

Cup and Handle Pattern Bear Trend Continuation for FXEURUSD by Cup And Handle Pattern In Bear Market The pattern takes some time to. the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. this guide will help you learn to trade the cup and handle pattern in both bullish and bearish market situations. a positive sign in the cup and handle pattern is a decrease in. Cup And Handle Pattern In Bear Market.

From www.investopedia.com

Cup and Handle Pattern How to Trade and Target with an Example Cup And Handle Pattern In Bear Market Learn how it works with an example,. The pattern takes some time to. This decrease indicates that selling pressure may be drying up and suggests that sellers are losing interest in the stock. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. cup and. Cup And Handle Pattern In Bear Market.

From howtotrade.com

How To Trade The Inverse Cup and Handle Pattern Cup And Handle Pattern In Bear Market a common stop level is just outside the handle on the opposite side of the breakout. Learn how it works with an example,. The inverted cup and handle is the bearish version that can form. a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart.. Cup And Handle Pattern In Bear Market.

From phemex.com

Cup and Handle Pattern How to trade it Phemex Academy Cup And Handle Pattern In Bear Market The pattern takes some time to. a common stop level is just outside the handle on the opposite side of the breakout. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the base of the cup. The inverted cup and handle is the bearish version that can form. the. Cup And Handle Pattern In Bear Market.

From www.learnstockmarket.in

Cup and Handle Pattern Meaning with Example Cup And Handle Pattern In Bear Market the cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend. cup and handle formations can fail at a 5% or higher rate during bear markets. To mitigate the risk of a failed. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in. Cup And Handle Pattern In Bear Market.

From forextraininggroup.com

Trading the Cup and Handle Chart Pattern for Maximum Profit Cup And Handle Pattern In Bear Market The pattern takes some time to. a common stop level is just outside the handle on the opposite side of the breakout. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the base of the cup. The inverted cup and handle is the bearish version that can form. This decrease. Cup And Handle Pattern In Bear Market.

From synapsetrading.com

Cup and Handle Pattern Trading Strategy Guide Synapse Trading Cup And Handle Pattern In Bear Market a cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Learn how it works with an example,. a positive sign in the cup and handle pattern is a decrease in trading volume, particularly in the base of the cup. cup and handle formations can. Cup And Handle Pattern In Bear Market.